Sustainability Policy

Sustainability Report

MIRAI publishes an annual “Sustainability Report” that summarizes its sustainability initiatives.

Sustainability Report (August 2025) PDF (5.9MB)

Top Message

Initiatives to address various issues related to sustainability have attracted increasing attention from the society in recent years. Real estate industry is no exception. Sustainability issues are recognized as mid- to long-term risk factor from investors around the world and some have already included investment corporation’s attitude toward action and track record into investment decision criteria, further heightening the impact.

As the asset manager of MIRAI Corporation, Mitsui Bussan & IDERA Partners Co., Ltd. believes that it is essential to tackle Environment, Society and Governance initiatives so as to realize sustainable society and that those initiatives will lead to mid-to long-term improvement of unitholder value, based on our philosophy that “MIRAI creates the future of the world”. The Asset Manager has already taken initiatives such as obtaining environmental certification for assets under management and sponsoring local events at properties under management. The Asset Manager has also formulated “Sustainability Policy” as the Asset Manager’s basic sustainability policy and will continue to strengthen ESG initiatives based on the policy. The Asset Manger and the MIRAI will pursue to improve the unitholder value of MIRAI through strengthening ESG initiatives as well as appropriate disclosures. We look forward to the continued support and encouragement of our unitholders.

Mitsui Bussan & IDERA Partners Co., Ltd.

Representative Director, President Michio Suganuma

Sustainability Policy

As the asset manager of MIRAI Corporation (hereinafter the “MIRAI”), Mitsui Bussan & IDERA Partners Co., Ltd. (hereinafter the “Asset Manager”) aims to realize sustainable society and manage MIRAI based on the philosophy that “MIRAI creates the future of the world”. The Asset Manager believes that it is essential to tackle Environment, Society and Governance initiatives (hereinafter the “ESG initiatives”) so as to realize sustainable society and that the pursuit of the ESG initiatives will lead to improvement of unitholder value. The Asset Manager has also formulated below “Sustainability Policy” and pursues ESG initiatives based on the policy.

(As of March 31, 2023)

1. Conservation of global environment through environmental management of the portfolio

Through internal environmental management structure, The Asset Manager aims to conserve global environment by appropriately understanding and managing the environmental impact related to the portfolio management. The Asset Manager takes initiatives towards reduction of greenhouse gas emission, efficient use of resources and energy, saving water and utilizing sustainable water sources, and reduction and proper disposal of waste, etc., in addition to thoroughly ensuring adherence to the environment related laws.

2. Consideration to environmental and social risks in asset management process

In acquisition due diligence and monitoring following the acquisition, the Asset Manager considers property’s environmental and social risks such as soil contamination, impact to biodiversity, indoor air quality, equipment and material’s impact to the environment and building safety and its impact to health, etc., and reflects them in investment decision making process.

3. Cooperation with external stakeholders

By developing good relationship through dialogue with external stakeholders such as tenants of assets under management, local communities, property management companies, operators, suppliers and investors, the Asset Manager aims to take initiatives to tackle environmental and social issues together with them, while striving for efficient operation, improved tenant satisfaction, and contribution to development of local communities.

4. Initiatives for the employees

The Asset Manager provides continuous education and career development opportunities for employees aiming to improve professional knowledge and capability while also striving to improve knowledge and understanding on sustainability and ESG. Further, with the understanding that employee’s health is an important asset to the Asset Manager, the Asset Manager aims to create an office environment whereby each employee can continue to work in a healthy and safe manner.

5. Respect for human rights and diversity, equity and inclusion (DEI)

The Asset Manager does not tolerate human rights infringements such as forced labor, child labor, discrimination and harassment in the business activities and respects basic human rights and labor rights. In addition, the Asset Manager respects diversity, equity and inclusion and aims to foster an organizational culture that allows diverse backgrounds and values to be promoted.

6. Disclosure of ESG information and securing transparency

In order to solidify mutual trust with various stakeholders, the Asset Manager discloses ESG related information actively and continuously in a timely and appropriate manner, while striving to obtain external evaluations such as environmental certifications and participating in ESG related initiatives.

7. Maintaining compliance

The Asset Manager ensures compliance with laws, fair transaction, appropriate management of information, prevention of corruption, and prevention of conflict of interest, and conduct the business activity fairly. In addition, through management training and regular internal audit, the Asset Manager strives to strengthen risk management and compliance structure.

8. Fiduciary duty and consideration to unitholder right

As an asset management company of a listed investment corporation, the Asset Manager responds appropriately to issues such as prevention of conflict of interest, securing transparency in relations to related party transactions, and constructive dialogue with the unitholders of MIRAI, and gives considerations to the unitholder right and fulfills fiduciary duty.

Sustainability Management Framework

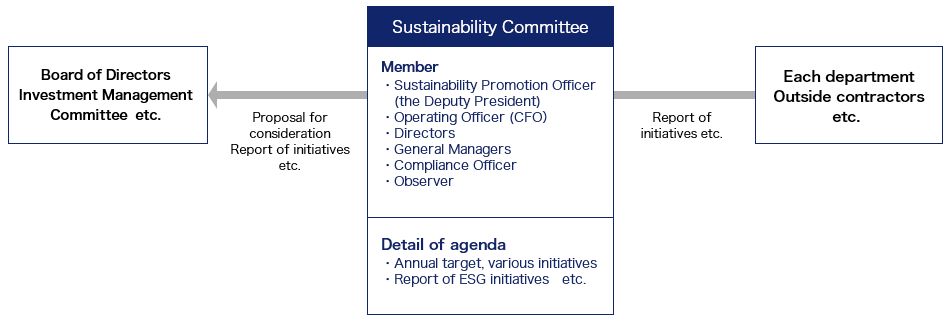

The Asset Manger has established “Sustainability Committee” to promote ESG initiatives in accordance with Sustainability Policy.

Sustainability Committee is led by the Sustainability Promotion Officer (for all aspects of sustainability), attended by Directors, General Managers and Compliance Officer.

As a general rule, Regular meetings are held approximately once every three months to discuss specific ESG targets and measures, as well as various initiatives, while taking into account social conditions and the operating status of the MIRAI.

Materiality (Material Issues) & SDGs

MIRAI and the Asset Manager have determined materiality (material issues) in the management of MIRAI in order to realize sustainable society as part of our corporate social responsibility, while recognizing the importance of considerations for ESG. Through our responses to materiality, we will aim to increase mid-to long-term unitholder value and contribute to the SDGs (Sustainable Development Goals).

| Materiality (Material Issues) | Key Initiatives | Related SDGs | |

|---|---|---|---|

| Environment | Adaptation to climate change (reduction of GHG emission and energy consumption, utilization of renewable energy etc.) | ・Setting of long-term targets for environmental performance results ・Introduction of energy-efficient equipment ・Consideration for an introduction of renewable energy |

|

| Structuring a portfolio with minimal environmental impact (reduction of water consumption and of waste consumption, acquisition of environmental certification etc.) | ・Promoting acquisition of environmental certification ・Asking stakeholders to cooperate in water conservation and waste reduction (distributing sustainability guides, displaying posters, etc.) |

|

|

| Society | Creating a work environment that takes into consideration the health, safety, and comfort of employees | ・Enhancement of training and certification acquisition support system ・Establishment of various welfare systems that take work-life balance into consideration |

|

| Consideration for tenants’ safety and security | ・Maintenance of various equipment and implementation of drills to prepare for large-scale disasters at properties owned ・Implementation of countermeasures against COVID-19 |

|

|

| Support for the promotion of local communities | ・Sponsorship of local events ・Providing venues for various events that contribute to local communities |

|

|

| Governance | Strength of governance system and risk management | ・Establishment of internal reporting system, etc. ・Conducting regular risk assessments ・Thorough awareness of compliance and training implementation |

|

| Promotion of information disclosure | ・Disclosure of various operational data ・Enhance dialogue with institutional and individual investors ・Use of third-party accreditation (GRESB, etc.) |

|

Materiality Identification Process

STEP1: Selection of issues to be considered

MIRAI and the Asset Manager selected sustainability issues by referring to the SDGs, various guidelines (e.g., SASB Standards, GRI Guidelines), and evaluation items of ESG rating agencies (e.g., MSCI, FTSE).

STEP2: Evaluating the importance of Issues

We evaluated the importance of each issue based on its impact on our management and the expectations of our stakeholders.

STEP3: Identification of Materiality

Materiality was determined through deliberations at Sustainability Committee and resolutions in accordance with the decision authority.

GRI Standards Reference Table

The following reference table shows the descriptions of each item of the “GRI Standards” on this website.

The "GRI Standards" are disclosure standards for reporting on economic, environmental, and social impacts of organizations, and have been adopted by many governments and companies around the world.

GRI Standards Reference Table (as of August 29, 2025) PDF (402KB)