Initiatives for Climate Change

Awareness of Climate Change

According to international reports such as the Paris Agreement and the IPCC (Intergovernmental Panel on Climate Change), the progression of climate change, including global warming, is a scientific fact, and climate change is expected to lead to growing occurrence and expansion of weather and climate disasters, including more intense typhoons and heavy rains, more frequent heat waves and droughts, and a global sea-level rise. As part of the worldwide efforts to mitigate climate change, the establishment of frameworks to reduce greenhouse gas emissions and the strengthening of emission regulations are expected in order to decarbonize the social economy, and efforts to achieve net-zero emissions by 2050 in particular are becoming increasingly important.

Mitsui Bussan & IDERA Partners Co., Ltd. (hereinafter "Asset Manager") and MIRAI Corporation (hereinafter "MIRAI") believe that climate change issues, in addition to the physical impacts of various disasters, etc. mentioned above, may have a significant impact on business activities in the process of and transition to a decarbonized society. The Asset Manager recognizes that enhancing business resilience by identifying, assessing, and managing the risks and opportunities posed by climate change is essential to increasing MIRAI’s unitholder value over the medium- to long-term.

Support for the Recommendations of the TCFD

The Asset Manager expressed support for the Task Force on Climate-related Financial Disclosures (TCFD) recommendations in order to promote disclosure on climate change in February 2023. The TCFD is a task force established by the Financial Stability Board (FSB) to examine climate-related disclosures and response policies of financial institutions. It views climate change as a serious risk to the global economy and has published recommendations for corporations and others to understand and disclose their "Governance," "Strategy," "Risk Management," and "Metrics and Targets" regarding climate -related risks and opportunities.

The Asset Manager has also joined “TCFD Consortium”. Many companies and organizations in Japan that support the TCFD participate in the TCFD Consortium, which discusses how information on climate-related issues should be disclosed and how it should be utilized.

Governance

The Asset Manager promotes sustainability initiatives including climate-related issues led by the Deputy President who is responsible for promoting overall sustainability. In addition, the Asset Manager has established "Sustainability Committee" attended by Directors, General Managers and Compliance Officer. The Committee discusses and deliberates on important matters related to climate-related issues, following which the Board of Directors of the Asset Manager and MIRAI hear reports and pass resolutions in accordance with the standards of the various regulations. Through this process, management and oversight of climate-related initiatives are carried out.

Please refer to here for sustainability management framework.

Strategy

Referenced scenarios

The risk analysis was conducted based on scenarios of rising temperatures developed by international organizations such as the International Energy Agency (IEA) and the IPCC as information sources. The main information sources referred to are as follows.

Scope of scenario analysis

All properties owned by MIRAI.

| 1.5℃ Temperature Increase Scenario | 4℃ Temperature Increase Scenario | |

|---|---|---|

| Transition risks | IEA NZE2050 | IEA STEPS |

| Physical risks | IPCC RCP 2.6 | IPCC RCP 8.5 |

| ※Transition risks: | It refers to the business impact of the transition to a low-carbon and decarbonized economy. They are risks posed by promotion of decarbonization through legislation, development of new technologies, fluctuations in energy prices, and loss of reputation among stakeholders. |

| ※Physical risks: | It refers to the business impacts caused by ongoing climate change and changes in climate patterns and weather phenomena from those of the past, and is classified into acute risk and chronic risk. Acute risk refers to risks caused by sudden weather events such as typhoons and floods, while chronic risk refers to risks caused by long-term changes in climate patterns such as prolonged high and low temperatures. |

Scenario analysis

The worldview of each scenario on which the Asset Manager based analysis is as follows.

4℃ Scenario

A worldview that assumes that sufficient climate change mitigation measures toward decarbonized society will not be realized, that greenhouse gas emissions will continue to increase, and that weather disasters will become more frequent and more severe due to global warming (a scenario with relatively high physical risk and low transition risk)

1.5℃ Scenario

A worldview that assumes that climate change mitigation measures such as social policies, emission controls, and technological investments toward a decarbonized society will progress, and that global warming will be curbed as greenhouse gas emissions decline (a scenario with relatively low physical risk and high transition risk)

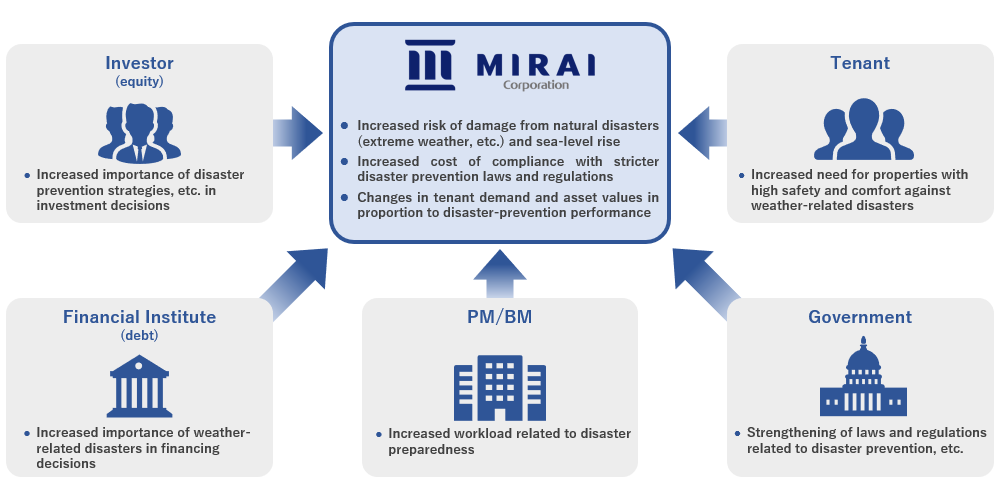

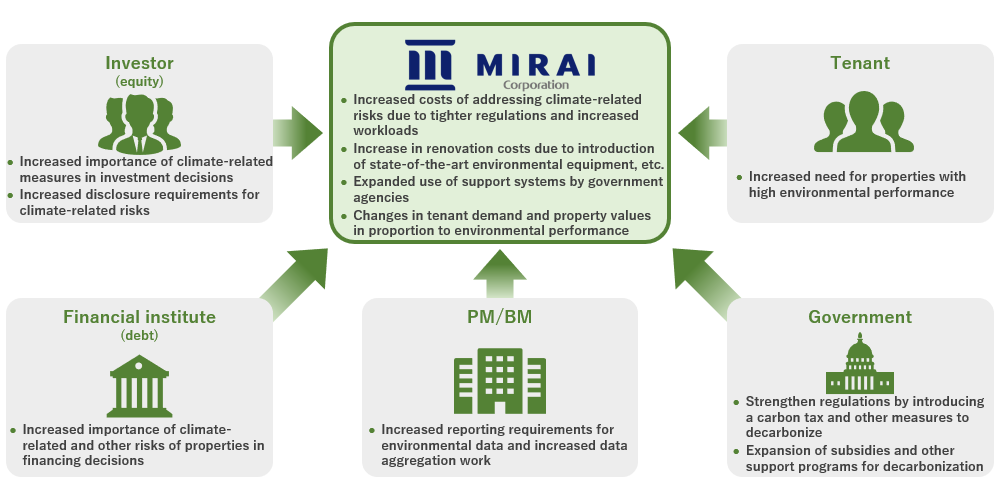

Qualitative climate-related assessment

| Category | Elements related to real estate management | Financial impacts | Risk management, response measures, initiatives, etc. | |||||

|---|---|---|---|---|---|---|---|---|

| 4℃ Scenario | 1.5℃ Scenario | |||||||

| Medium- term |

Long- term |

Medium- term |

Long- term |

|||||

| Transition risks | Policy and legal |

Introduction of carbon taxes and GHG emission regulations |

|

Small | Small | Medium | Large |

|

| Strengthening energy conservation standards |

|

Small | Small | Small | Medium |

|

||

| Stricter reporting requirements for energy-related and GHG-related data and expansion and mandating of disclosure systems |

|

Small | Small | Small | Small |

|

||

| Technology | Evolution of energy-saving technologies / Penetration of renewable energy |

|

Small | Small | Medium | Medium |

|

|

| Market | Reflecting environmental performance in real estate appraisal values |

|

Small | Small | Medium | Large |

|

|

| Deterioration in financing conditions due to delays in response to climate change |

|

Small | Small | Medium | Medium |

|

||

| Changing tenant needs for environmental performance |

|

Small | Small | Medium | Large |

|

||

| Reputation | Decrease in brand value due to delays in addressing climate change |

|

Small | Small | Small | Medium |

|

|

| Physical risks | Acute | Increase in typhoons, torrential rains, floods, and inundation damage |

|

Medium | Large | Small | Small |

|

| Chronic | Progressive sea-level rise |

|

Medium | Large | Small | Small |

|

|

| Occurrence of extreme weather conditions (e.g., extremely hot or extremely cold days) |

|

Medium | Medium | Small | Small |

|

||

| Opportunities | Resource efficiency |

Provide energy-saving equipment and services to tenants |

|

Small | Small | Small | Medium |

|

| Market | Increased demand for properties with high environmental performance |

|

Small | Small | Small | Medium |

|

|

| Expansion of investor base |

|

Small | Small | Small | Small |

|

||

- The medium-term assumes a period of 4-10 years, and beyond that is considered as the long-term. This analysis used scenarios and objective forecast data presented by third-party specialized organizations at the time as reference, and was performed based on the status of MIRAI's portfolio. However, it involves uncertainties of known risks, unknown risks and other factors, and consequently, not does not guarantee of the accuracy or safety of the information.

Risk Management

The Asset Manager's climate-related risk management system is as follows.

Identification and assessment of risks

In identifying risks, the Asset Manager endeavors to assess the timeline (timing and duration of the risk materializing), the certainty (possibility of the risk materializing) and the impact (financial impact to the Asset Manager and MIRAI) by each risk and scenario. If a theme or factor that can provide business opportunity for the Asset Manager and MIRAI is recognized in risk identification process, it is recorded as climate-related opportunity separate from the risks. After considering its feasibility etc., where possible, financial impact, feasibility and return on investment, etc. for each scenario are evaluated.

The Sustainability Committee deliberates on climate-related risks that need to be addressed with higher priority based on the assessment etc. regarding the certainty and impact of such risks and prioritize them to be managed. When a report is made on climate-related opportunities, they are prioritized for business strategy following their assessment similar to that of risks. For the process of identification and assessment of the above climate-related risks and opportunities, department in charge presents the comprehensive review based on opinions of the related departments to the Sustainability Committee which makes decisions and reporting based on various regulations.

Management of risks

The Asset Manager aims to secure long-term sustainable and stable profit through management of the identified and assessed climate-related risks and opportunities and through pursuit of initiatives that improve resilience. The person responsible for promotion of sustainability designates a staff in charge of formulating responses to the important climate-related risks and opportunities that are deliberated by the Sustainability Committee. The formulated response, depending on its content, is implemented following deliberation and resolution based on the authority stipulated in the rules of the Asset Manager and MIRAI. The person responsible for promotion of sustainability also endeavors to integrate process of identification, assessment, and management of risks by instructing the important climate-related risks to be examined under the existing company-wide risk management program.

Metrics and Targets

The Asset Manager and MIRAI will work on various measures to achieve net zero by 2050 as advocated by the international community, set indicators and targets to manage climate-related risks and opportunities, and monitor environmental performance data.

Please refer to Environmental Performance Data and Sustainability Report for changes in metrics and targets.