Compliance

When managing assets, MIRAI aims to align the interests of sponsors, Mitsui & Co. Group and IDERA, with the interests of unitholders and to adopt an operating structure that ensures conflicts of interest are handled fairly. MIRAI's policy is to seek to develop a neutral and transparent governance structure with these two aims as the central framework.

Governance structure

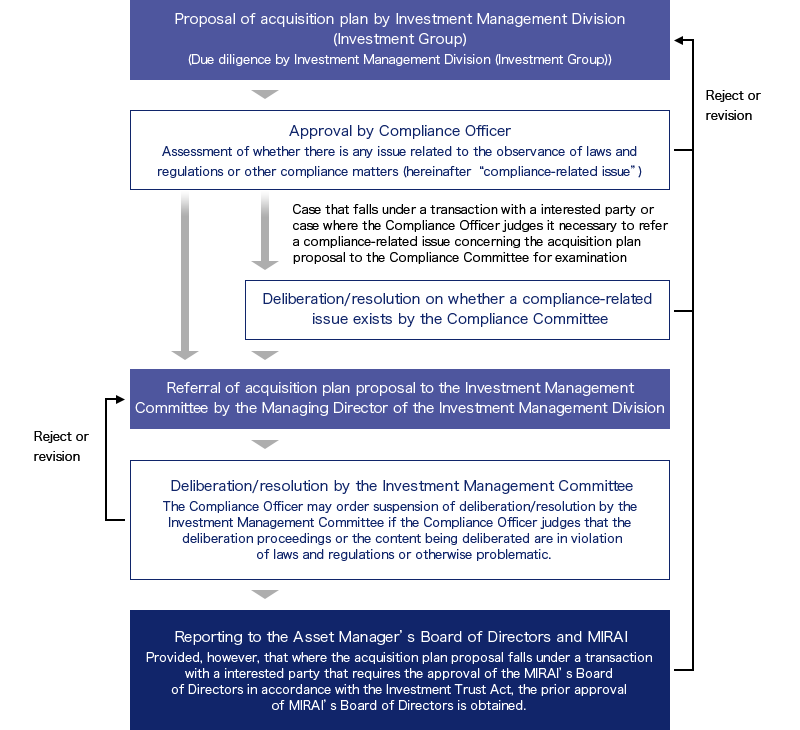

MIRAI has established a governance structure that ensures conflicts of interest are handled fairly through the adoption of a system that requires significant transactions such as the acquisition of assets from interested parties to be reported to the Asset Manager's Board of Directors and MIRAI's Board of Directors via prior deliberation by the Asset Manager's Compliance Officer and deliberation and resolution by the Compliance Committee and Investment Management Committee (provided, however, that the prior approval of MIRAI's Board of Directors is required in the case of certain transactions with related parties defined in the Act on Investment Trusts and Investment Corporations of Japan (hereinafter "Investment Trust Act")).

Flow of Decision-Making for Acquisitions of Assets

In addition, MIRAI has established a structure for acquiring assets at an appropriate price and under appropriate conditions from the viewpoint of protecting the rights of unitholders, including measures against conflicts of interests in interested party transactions.